vermont state tax brackets

Vermont also has a 600 percent to 85 percent corporate income tax rate. See it in action.

Vermont Property Tax Rates Nancy Jenkins Real Estate

The site is secure.

. These income tax brackets and rates apply to Vermont taxable income earned January 1 2020. TAX TABLES Place at. Before sharing sensitive information make sure youre on a state government site.

Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. 68 on taxable income between 37451 and 90750.

Before sharing sensitive information make sure youre on a state government site. These taxes are collected to provide essential state functions resources and programs to. The Vermont State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Vermont State Tax CalculatorWe also provide.

Ad Learn More About the Adjustments to Income Tax Brackets in 2022 vs. As you can see your Vermont income is taxed at different rates within the given tax brackets. Avalara calculates collects files remits sales tax returns for your business.

Vermont Tax Brackets for Tax Year 2020 As you can see your Vermont income is. If Taxable Income is. Rates range from 335.

Income tax tables and other tax. State government websites often end in gov or mil. 2021 Income Tax Withholding Instructions Tables and Charts.

State government websites often end in gov or mil. 2020 VT Tax Tables. Get the Credits Deductions Refund You Deserve.

Vermonts income tax rates are assessed over 5 tax brackets. Ad All Tax Brackets Supported. Any income over 204000 and 248350 for.

Before sharing sensitive information make sure youre on a state government site. Vermont based on relative income and earningsVermont state income taxes are listed below. Vermont Income Taxes.

The latest Vermont state income tax brackets table for the Married Filing Jointly filing status is shown in the table below. The site is secure. These income tax brackets and rates apply to.

2016 VT Rate Schedules and Tax Tables. State government websites often end in gov or mil. Ad Avalara AvaTax lowers risk by automating sales tax compliance.

Vermont Income Tax Rate 2020 - 2021. At Least But Less Single Married Married Head of. Detailed Vermont state income tax rates and brackets are available on this page.

Vermonts 2022 income tax ranges from 335 to 875. And your filing status is. 2020 VT Rate Schedules.

Income tax brackets are required state taxes in. Discover Helpful Information and Resources on Taxes From AARP. The Vermont Single filing status tax brackets are shown in the table below.

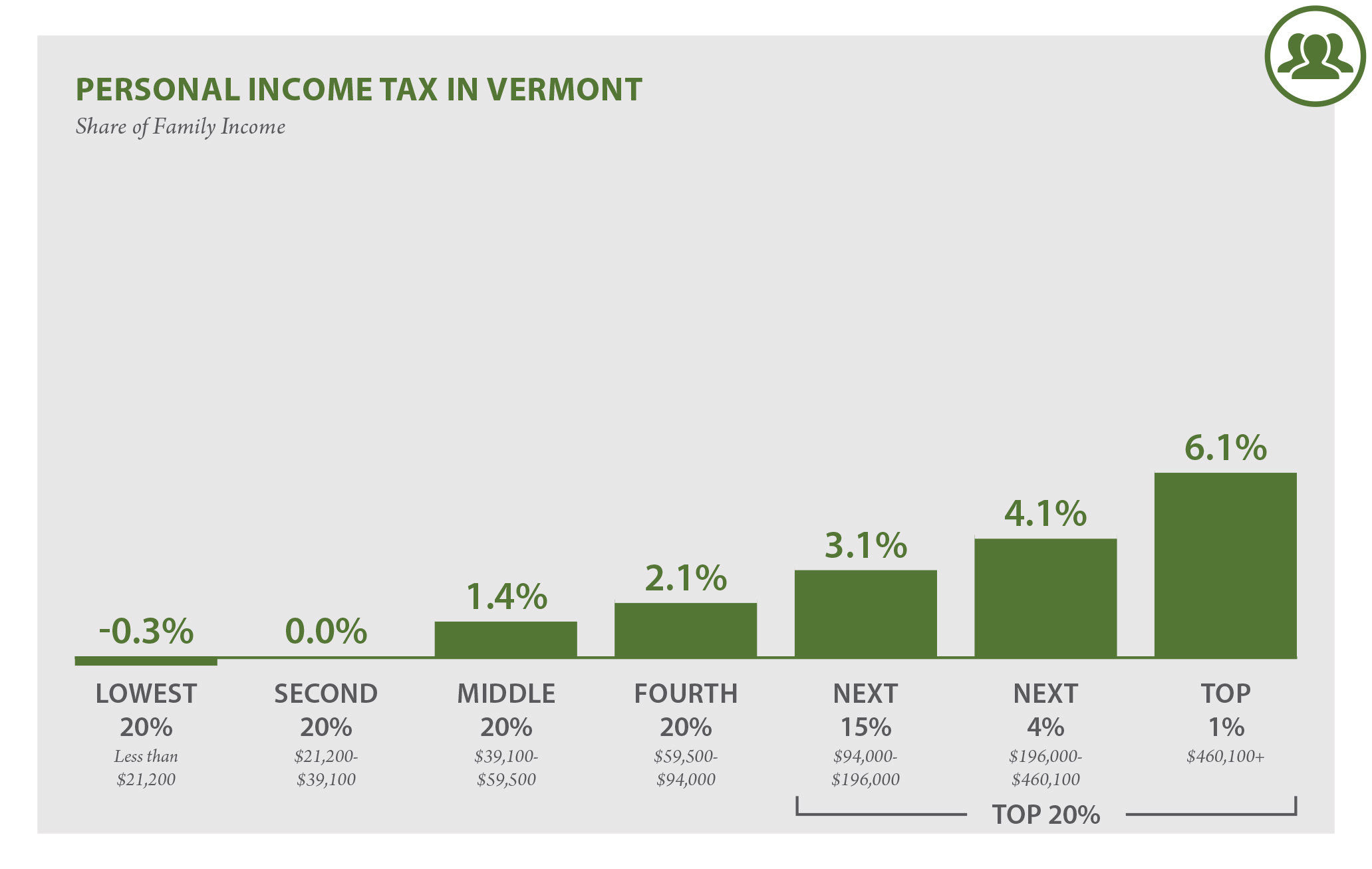

Vermont Tax Brackets for Tax Year 2020. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66. Vermont also has a 600 percent to 85 percent corporate income tax rate.

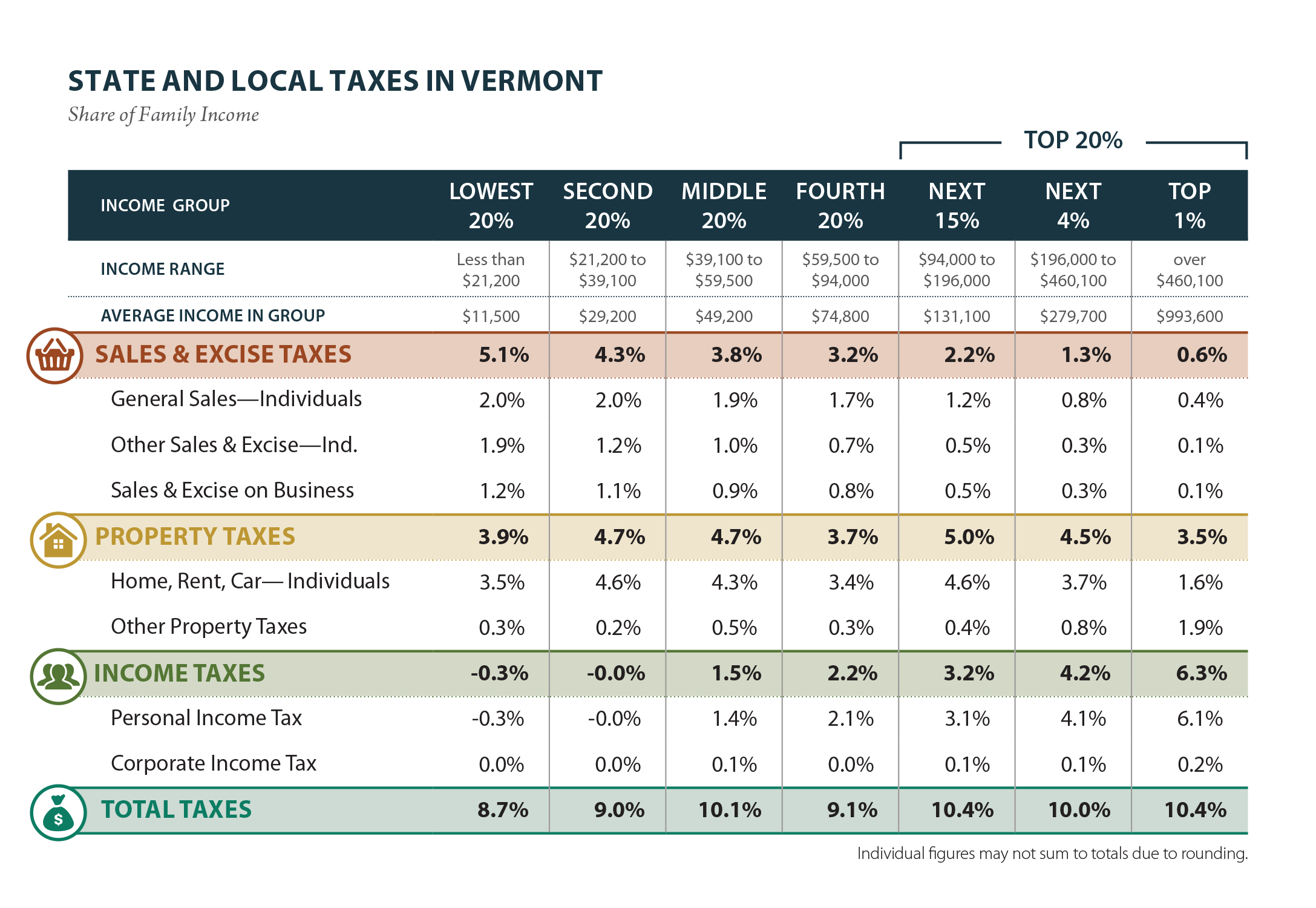

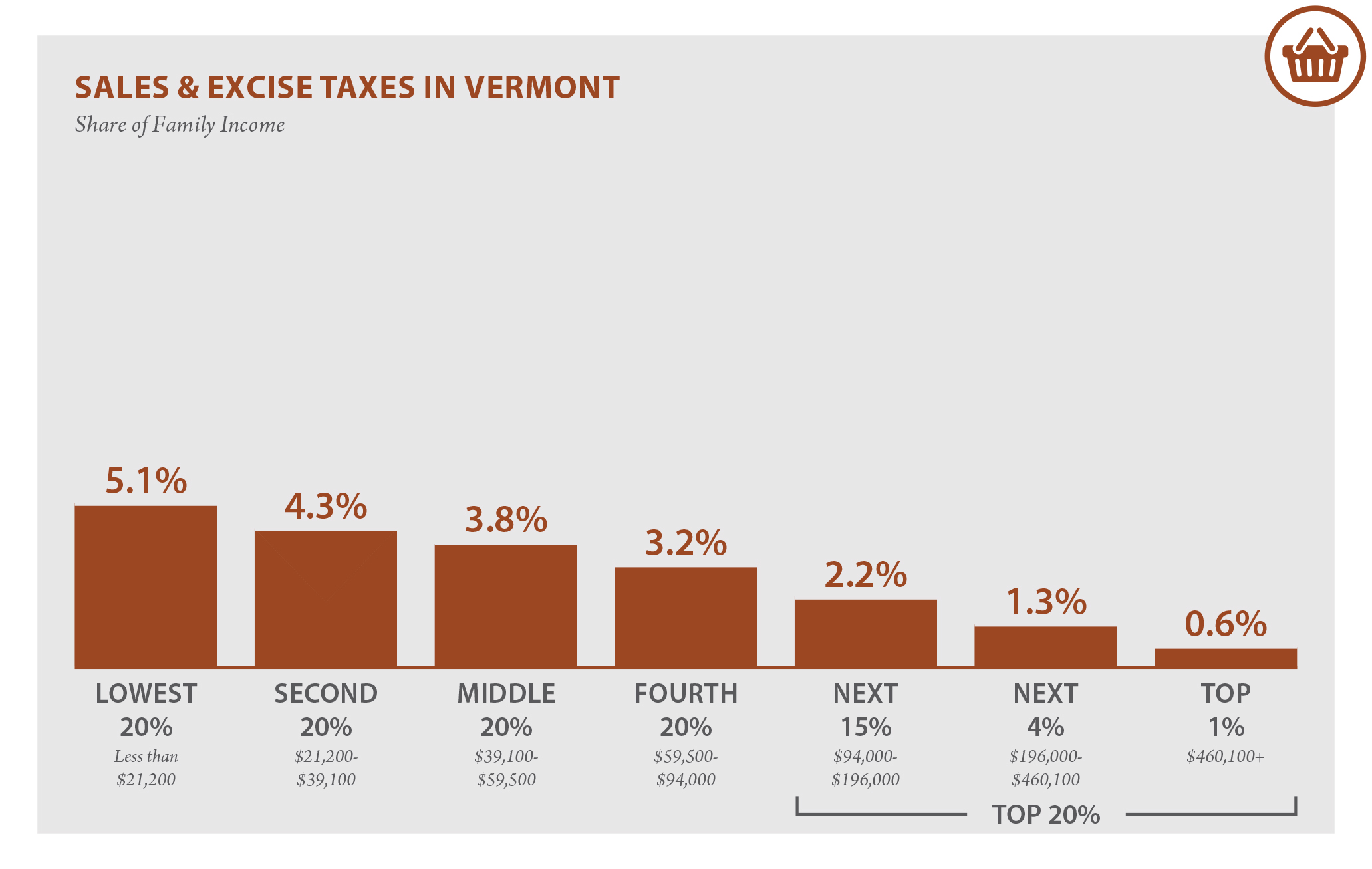

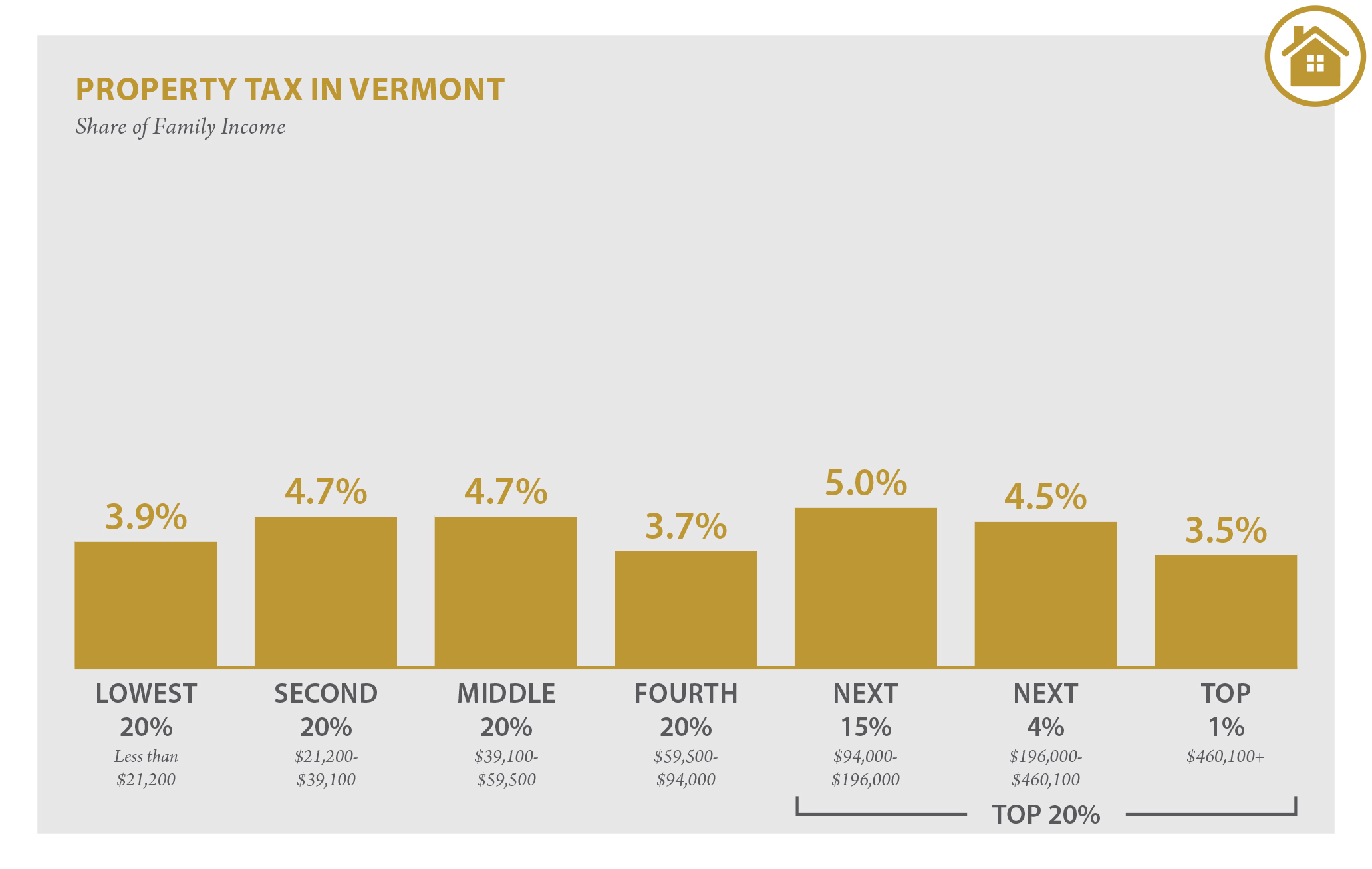

In addition check out your federal tax. The major types of local taxes collected in Vermont include income property and sales taxes. The Green Mountain State has a steep top income tax rate 875 although most taxpayers dont pay that much.

The site is secure. Plus Vermonts statewide median property tax rate is the fifth. Expert News Commentary Trusted Analysis Time-saving Practice Tools.

Ad Analysis from Leading Practitioners and the Resources You Need to Make Informed Decisions. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. Than filing filing house- jointly.

State Cigarette Tax Rate dollars per 20-pack 308. Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. 355 on the first 37450 of taxable income.

The state income tax rate in Vermont is progressive and ranges from 335 to 875 while federal income tax rates range from 10 to 37 depending on your income. This page has the latest Vermont brackets and tax rates plus a Vermont income tax calculator. Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent.

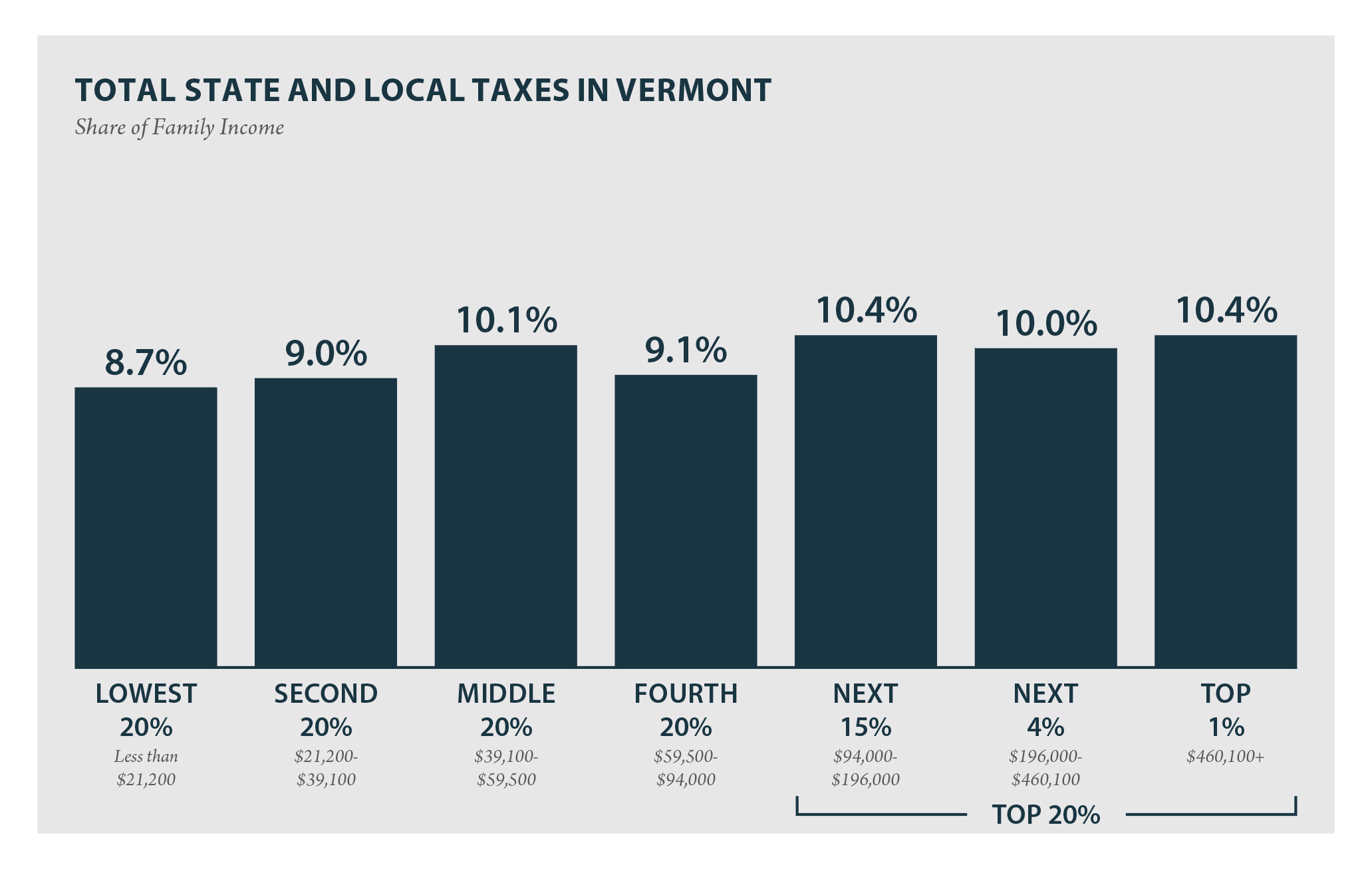

Vermont Who Pays 6th Edition Itep

The Most And Least Tax Friendly Us States

Vermont S Income Taxes Are Lower Than Many Other States Public Assets Institute

Vermont Corporate Income Tax Rate 12th Highest Vermont Business Magazine

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Who Pays 6th Edition Itep

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Who Pays 6th Edition Itep

Vermont Who Pays 6th Edition Itep

Vermont Who Pays 6th Edition Itep

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Historical Vermont Tax Policy Information Ballotpedia

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

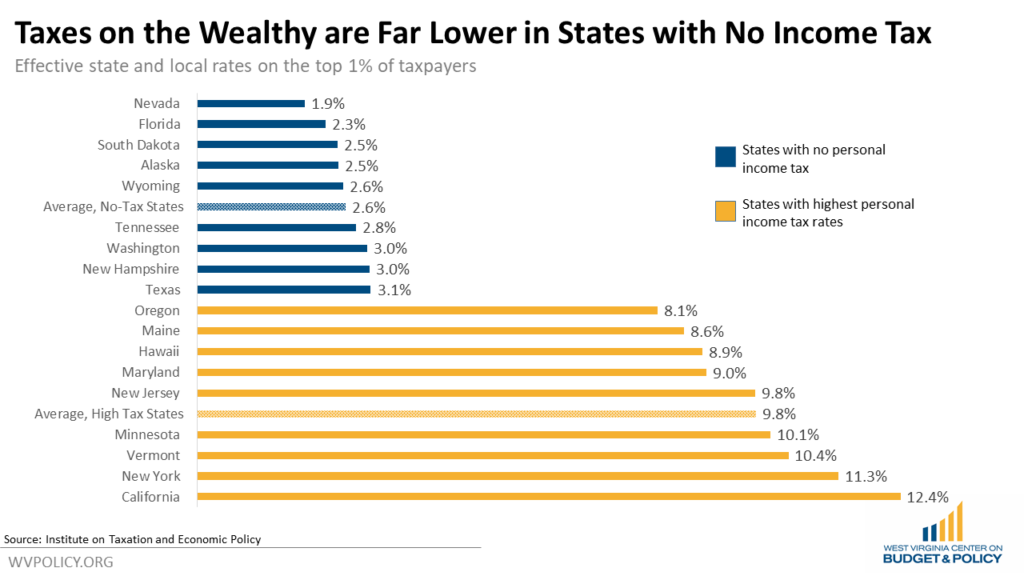

Eliminating The Income Tax Benefits The Wealthy While Undermining Important Public Investments West Virginia Center On Budget Policy